Tube Ninja Insights

Your go-to source for the latest trends and tips in video content creation.

Diving Deep: Navigating the Waves of Marketplace Liquidity Models

Unlock the secrets of marketplace liquidity models! Dive deep and discover strategies to navigate the waves of trading success.

Understanding Marketplace Liquidity: Key Models Explained

Marketplace liquidity refers to the ease with which assets can be bought or sold in a market without causing a significant impact on their price. Understanding liquidity is crucial for both investors and traders, as it directly affects transaction costs and investment strategies. There are several key models that explain how liquidity operates. The order book model, for instance, showcases how buyers and sellers submit orders, creating a queue of transactions that reflect market demand and supply. A deeper dive into this model reveals how bid-ask spreads represent the liquidity of an asset - narrower spreads indicate higher liquidity, while wider spreads suggest the opposite.

Another important model is the market maker model. In this scenario, liquidity is provided by market makers who are willing to buy and sell assets continuously, thereby facilitating smoother trades. Market makers profit from the spread between the buying and selling prices, incentivizing them to maintain high trading volumes. Understanding these models not only helps traders identify the best points to enter or exit but also allows investors to manage risks effectively. Overall, grasping the dynamics of market liquidity is essential for optimizing trading performance and achieving financial goals.

Counter-Strike is a popular tactical first-person shooter that emphasizes team play and strategy. Players can take on the roles of terrorists or counter-terrorists, engaging in intense matches that require skill and teamwork. For those looking to enhance their gameplay experience, using a daddyskins promo code can provide valuable in-game items and skins.

The Impact of Market Liquidity on Trading: A Comprehensive Guide

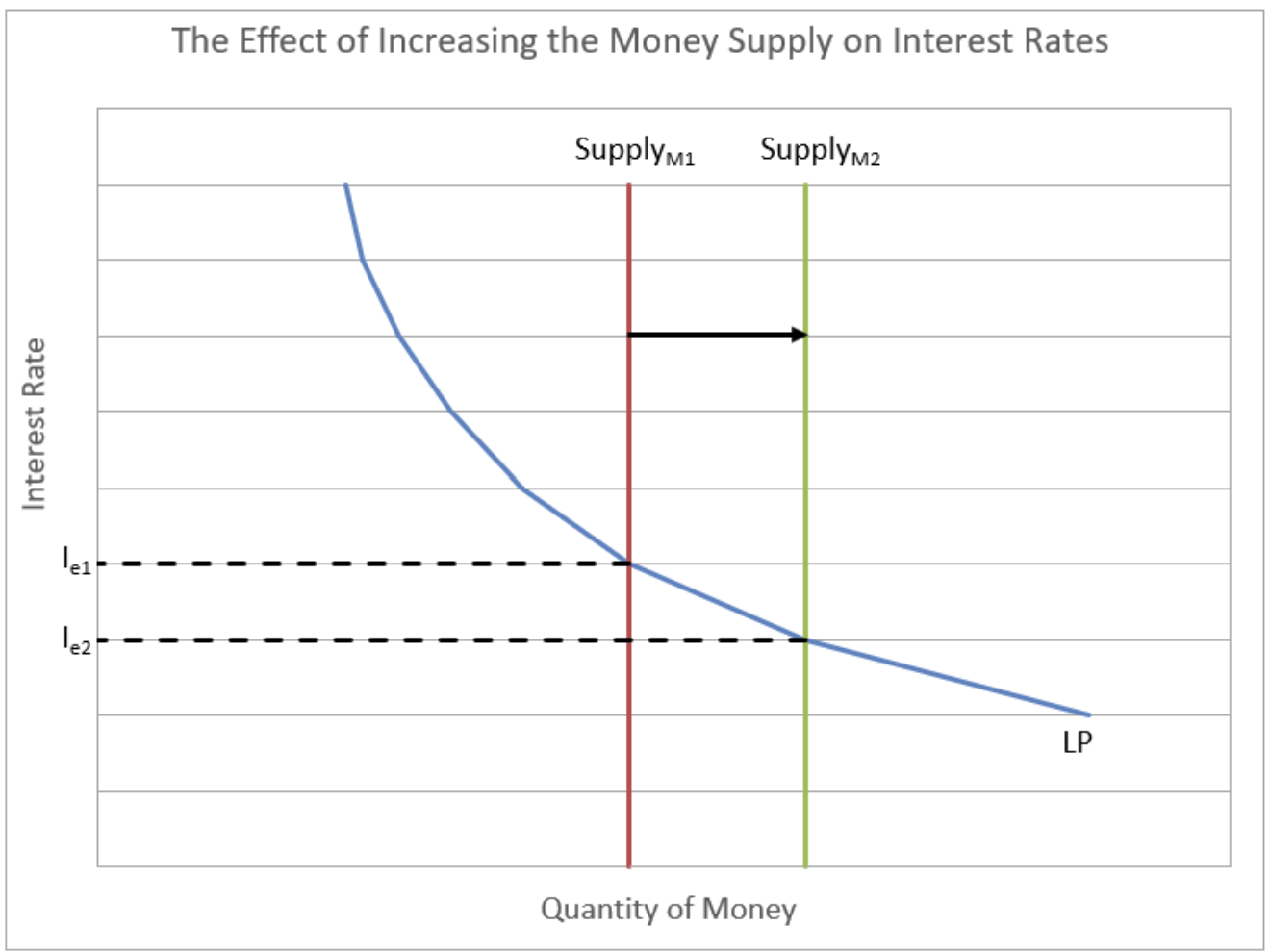

Market liquidity plays a crucial role in the trading landscape, impacting how efficiently assets are bought and sold. When liquidity is high, traders can execute orders quickly without significant price fluctuations, fostering a stable trading environment. Conversely, in a low liquidity market, large transactions can lead to sharp price swings, making it challenging for traders to enter or exit positions without incurring substantial costs. Understanding the dynamics of market liquidity is essential for traders aiming to maximize their profitability and minimize risk.

Moreover, market liquidity can be fundamentally affected by various factors such as economic conditions, market sentiment, and the presence of institutional investors. For instance, during a financial crisis, liquidity can dry up as participants retreat from the market, resulting in wider bid-ask spreads and increased volatility. Traders must be aware of these shifts and adjust their strategies accordingly. To navigate these challenges, it's advisable to consider employing risk management techniques and to stay informed about market trends to make educated trading decisions.

How Do Different Liquidity Models Affect Marketplace Performance?

The impact of different liquidity models on marketplace performance is profound and multifaceted. Liquidity refers to how easily assets can be bought or sold without affecting their price, influencing not only the trading experience but also the overall market dynamics. For instance, marketplaces that utilize a constant product market maker model ensure that liquidity remains available regardless of the marketplace conditions, promoting a seamless trading experience. In contrast, models that rely on order books, which can have varied depth depending on the number of active traders, may lead to spikes or drops in prices, impacting investor confidence and market stability.

Moreover, the choice of liquidity model can greatly affect transaction speed and cost. In a marketplace using an automated market maker (AMM) model, trades can be executed almost instantaneously, providing traders with the advantage of speed. However, this model often requires higher transaction fees due to the impermanent loss factor, which can discourage participation from sensitive investors. In contrast, marketplaces with traditional order books might have lower fees but can suffer from slower execution times, ultimately affecting user retention and overall market efficiency. The consequences of these liquidity models underline the importance of strategically selecting the appropriate structure to enhance marketplace performance.