Tube Ninja Insights

Your go-to source for the latest trends and tips in video content creation.

The Surprising Benefits of Whole Life Insurance You Didn't Know About

Unlock unexpected advantages of whole life insurance that can transform your financial future—discover what you've been missing!

Unlocking Hidden Values: 5 Benefits of Whole Life Insurance You Might Overlook

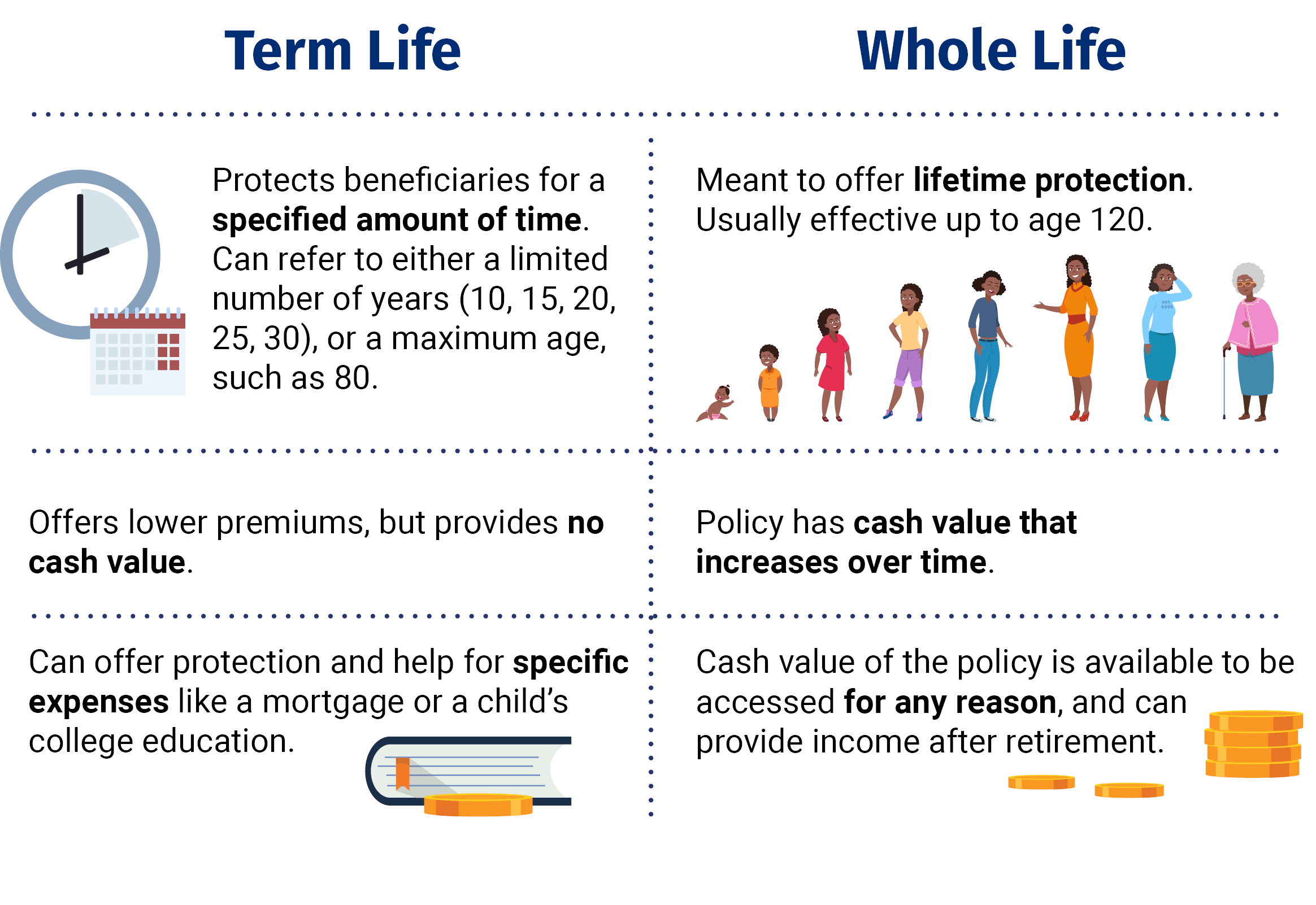

Whole life insurance is often viewed merely as a safety net, but it can offer multiple hidden values that many policyholders overlook. One of the most significant benefits is the cash value accumulation. As you pay your premiums, a portion of that money goes into a savings component that grows over time. This cash value can be borrowed against or withdrawn if needed, providing a source of funds for emergencies, investments, or big life purchases. Unlike term life insurance, which only pays out upon death, whole life insurance can be a versatile financial asset throughout your life.

Additionally, whole life insurance offers guaranteed death benefits, ensuring your loved ones are financially secure after your passing. This benefit is often overlooked because people focus heavily on immediate costs rather than long-term value. Moreover, the policy's cash value grows at a guaranteed rate, making it a stable addition to your financial portfolio. Tax advantages also come into play; the death benefit is typically tax-free, and the cash value growth is tax-deferred until you withdraw it, potentially aiding in wealth preservation. Consider these benefits when evaluating your financial strategy and protecting your family's future.

Is Whole Life Insurance Worth It? Discover the Unexpected Advantages

When considering whether whole life insurance is worth it, many individuals focus primarily on the cost versus the benefits. However, the unexpected advantages can significantly outweigh initial reservations. Whole life insurance not only provides a death benefit but also builds cash value over time. This cash value can be accessed through loans or withdrawals, making it a versatile financial instrument. As the policy matures, the cash value accumulates, offering policyholders a form of savings that can be used for emergencies, investments, or even retirement planning.

Additionally, whole life insurance policies can offer peace of mind that is hard to quantify. Many people appreciate the certainty of locked-in premiums and guaranteed benefits, creating a sense of financial security. This can be particularly valuable for families looking to ensure their loved ones are financially protected, regardless of life’s uncertainties. Furthermore, the predictable nature of whole life insurance also allows for better financial planning, helping individuals to stay on track with their long-term goals. Therefore, while the decision may initially seem daunting, the long-term benefits often reveal that whole life insurance is indeed worth the investment.

How Whole Life Insurance Can Be Your Secret Financial Asset

Whole life insurance is not just a safety net for your loved ones; it can also serve as a powerful financial asset that promotes long-term wealth accumulation. Unlike term life insurance, which expires after a set period, whole life insurance offers lifetime coverage and builds cash value over time. This cash value grows at a guaranteed rate, allowing you to access funds for various needs such as education expenses, retirement planning, or even emergencies. As a policyholder, you can take tax-free loans against the accumulated cash value, effectively turning your policy into a financial resource while still enjoying the protection it provides.

Investing in whole life insurance can be particularly advantageous as it blends insurance protection with investment growth. The cash value not only enhances your overall financial portfolio but can also serve as a safety net during volatile market conditions. Insurance experts often recommend viewing whole life insurance as a unique asset class that diversifies your investments. Additionally, the death benefit is generally non-taxable, meaning your beneficiaries will receive the full amount without tax implications. By incorporating whole life insurance into your financial strategy, you’re leveraging a multi-faceted tool that can support both your immediate needs and long-term financial goals.